Generative AI is rapidly reshaping how decisions are made in financial investment and stock trading. Although early AI models have been around for over a decade—Betterment, the first robo-advisor, debuted in 2008—many current platforms still rely on basic automation and passive portfolios grounded in modern portfolio theory.

But a new wave is emerging.

Next-generation robo-advisors can simulate countless economic scenarios and identify optimal investment strategies for each. Some AI-driven platforms can even generate novel trading approaches in milliseconds.

JPMorgan Chase is among the firms making major investments in this space. The company is developing IndexGPT, a generative AI system designed to build personalized investment portfolios. JPMorgan has already applied for a trademark, and signs suggest a potential launch within the next three years.

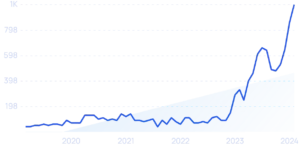

As the technology advances, so does adoption. Forecasts indicate robo-advisor assets under management will surpass $1.8 billion in 2024 and grow at nearly an 8% CAGR through 2027, reaching about $2.27 billion.

Demand for AI-powered guidance is also climbing. A 2023 Capgemini study found that more than half of individuals trust generative AI to help with financial planning. Meanwhile, a survey by the Certified Financial Planner Board of Standards showed that nearly one-third of investors would use AI as their primary advisor and would feel comfortable following its advice without a second opinion. Over half said they would trust AI recommendations if they could independently verify them.