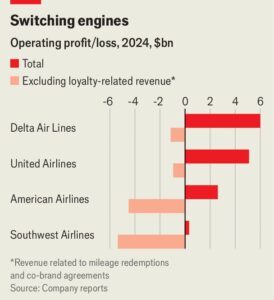

A recent analysis of major U.S. airlines’ operating profits for 2024 reveals a striking dependence on loyalty-related revenue to maintain profitability. According to company reports, when revenue from mileage redemptions and co-brand agreements is excluded, several leading carriers would have faced significant operating losses.

Delta Air Lines leads the pack with a total operating profit of around $6 billion, yet without loyalty-related revenue, it would have been operating at a loss of roughly $1 billion.

United Airlines follows with nearly $5 billion in total profit. However, excluding loyalty income drops it into the red by about $1 billion.

American Airlines shows a modest profit of just over $2 billion, but its underlying operations excluding loyalty programs would have lost around $4 billion—a substantial gap that highlights heavy reliance on non-core income.

Southwest Airlines demonstrates a more marginal performance, reporting close to breakeven total profit, yet without loyalty revenue, it would have posted losses nearing $5 billion.

This data underscores how loyalty programs—particularly frequent flyer mileage redemptions and co-branded credit card agreements—have become a lifeline for major airlines. Without these programs, the industry’s operating landscape would look markedly different, with most carriers slipping into significant losses.

As airlines face rising operational costs and shifting travel demand, loyalty programs may continue to serve as the financial engines keeping their businesses aloft. However, this dependency also raises questions about the long-term sustainability of airline profitability, especially if consumer travel patterns or co-brand partnerships shift.